- Business and Financial Information

- Management Policy

Corporate Governance

Basic Approach

The Net One Group will achieve continuous growth based on its corporate philosophy. Aiming for an enhancement of our corporate value over the medium to long term, we are working continuously to improve and strengthen corporate governance to ensure transparent, fair, prompt, and decisive decision-making.

The basic approach to corporate governance is stipulated in Article 1 of the Corporate Governance Guidelines

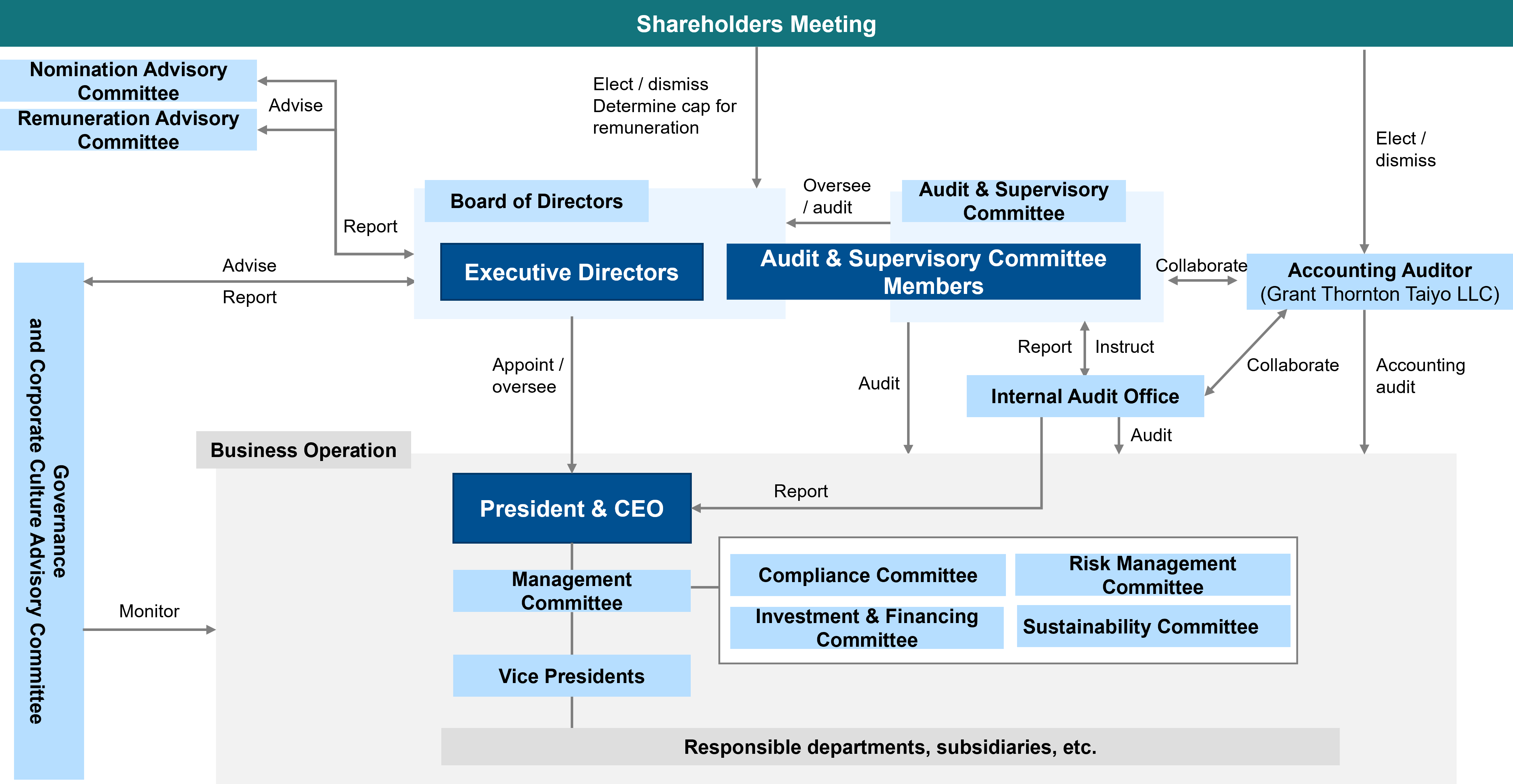

Corporate Governance Structure

The Company is working to establish a highly effective corporate governance structure through several measures. We conduct supervision and audits of management and the execution of duties by the Board of Directors (the majority of whom are independent outside executive directors) and the Audit & Supervisory Committee. We have also strengthened the business management and supervisory functions of the Board of Directors by introducing a vice president system, and improved the efficiency and speed of business execution. Furthermore, we work to ensure fairness and objectivity through the nomination and remuneration of directors and vice presidents by the Nomination Advisory Committee and the Remuneration Advisory Committee.

Independence Standards

The Company has established Independence Standards for outside executive directors and outside Audit & Supervisory Board members as follows, and deems that any outside executive director and outside Audit & Supervisory Board member who do not fall under any of following items possess independence from the Company with no risk of a conflict of interest with general shareholders.

Board of Director meetings

Activities for fiscal year 2023

| Number of Board of Directors meetings | held 18 times |

|---|---|

| Number of Audit & Supervisory Committee (Audit & Supervisory Board) meetings | held 13 times |

| Rate of attendance at Board of Directors Meetings by outside executive directors | 100% |

| Rate of Audit & Supervisory Committee (Audit & Supervisory Board) meeting attendance among committee (board) members | 100% |

Major Details of Discussions Held during Meetings of the Board of Directors

- Basic management policy

- Our Medium-Term Business Plan

- Measures aimed at realizing management conscious of cost of capital and stock prices

- Visualization

- Ideal vision for out Broad of Directors

- Skill matrix

- Executive remuneration system

- Evaluation of effectiveness of the Board of Directores and report of Interal audit

Evaluation of effectiveness of the Board of Directores

Board Advisors Japan, Inc. (“BAJ”), a third-party organization, analyzed and evaluated how effective the Company’s Board of Directors was during fiscal 2023 in accordance with Article 6 of the Company’s Corporate Governance Guidelines.

Purpose of conducting third-party evaluation and analysis and evaluation method

Previously, we had conducted questionnaire-based selfevaluations and analyses of the effectiveness of our Board of Directors, with the aim of improving its functions and thereby enhancing our corporate value.

The Net One Group has enhanced its supervisory functions by transitioning into a company with an audit and supervisory committee and implementing a monitoring

board system under which its Board of Directors is chaired by, and primarily consists of, independent outside executive directors. At the same time, the Group has strengthened its executive functions through measures such as forming a team of chief executives who serve as functional managers in their respective fields and delegating authority to vice presidents and other executives.

In order to evaluate the effectiveness of these initiatives aimed at enhancing corporate governance, including the reform of our Board of Directors, from a professional and

objective perspective, we requested BAJ, a third-party organization, prepare a questionnaire and conduct an evaluation and analysis for fiscal 2023, with the aims of establishing our most substantial corporate governance reform efforts to date and further enhancing our corporate value.

Executive Remuneration System

As an advisory body to the Board of Directors, we have established a Remuneration Advisory Committee that deliberates and reports on matters such as the remuneration of executive directors and vice presidents in order to strengthen our corporate governance by enhancing the transparency and fairness of the remuneration of executive directors and vice presidents.

Policy on dialogue with shareholders

The Company considers dialogue with shareholders to be important from the perspective of sustained growth and medium- to long-term increases in corporate value.

- Depending on the purpose of the dialogue, senior members of the management team or other executives should take the initiative in dialogue with shareholders.

- The department in charge of public relations and investor relations conducts dialogue with shareholders, overseen by the executive director responsible for the department. Departments in charge of public relations and investor relations, corporate planning, finance and accounting, legal and CSR support dialogue with shareholders by organic collaboration, such as sharing information.

- The Company is proactive in holding quarterly earnings results briefings for analysts and institutional investors, business presentations after Ordinary General Meetings of Shareholders for individual investors, overseas IR presentations, as well as feeding back the views and concerns of investors to the Board of Directors and other internal committees as appropriate.

- The Company has established regulations to prevent insider trading and is committed to strict management of insider information to prevent the leaking of such information outside the Company through dialogue with shareholders.

Enhancement of Opportunities for Dialogue with Shareholders and Investors

To facilitate constructive dialogue with shareholders and investors, we endeavor to enhance their understanding of our Company while proactively disclosing all information that we deem valuable in this regard. At the same time, we strive to foster comprehension of our business activities and growth strategies through both direct and indirect forms of communication, including financial results briefings for analysts and institutional investors, small meetings with institutional investors, and individual consultations.

Initiatives concerning Communication with Shareholders and Investors for fiscal year 2023

|

Dialogue with shareholders and investors |

Actual counts | Activity details |

|---|---|---|

| Financial results briefings for analysts and institutional investors | 4 | Quarterly financial results briefings for analysts and institutional investors are held on the day upon which corresponding quarterly financial results are announced. Full-year and half-year results are primarily presented by our CEO, while results for Q1 and Q3 are principally explained by vice presidents of the Company. |

| Business strategy briefings, technical workshops (netone tech excellence) |

1 | Business strategy briefings and technical workshops held for analysts and institutional investors |

| Regular briefings for overseas investors | 1 |

Our CEO visits and holds individual meetings with institutional investors |

| Small meetings with analysts and institutional investors | 6 | Small meetings attended by our CEO, and outside exective directors |

| Personal meetings held with individuals in charge of exercising voting rights on behalf of institutional investors | 13 | In addition to the CEO, meetings are attended by our CHRO, CRO, and CCO to enhance sustainability and governance enhancement initiatives. Additionally, the independent outside executive director participates in these meetings to improve outside executive directors’ understanding of shareholder sentiments and ensure that this understanding is utilized to strengthen oversight of management. |

| (attended by outside exective directors) | (6) | |

|

Individual meetings with analysts and institutional investors (breakdown below) |

333 |

Our IR Division is responsible for maintaining dialogue with shareholders, and the corporate officer in charge of this division is charged with the administration of this dialogue. In accordance with established objectives, the IR Division facilitates communication with shareholders through senior management and executive directors (including independent outside executive directors), including our CEO and CFO. |

|

(CEO, CFO, and senior management) |

(24) | |

| (IR Division) | (309) |

Feedback for management

| Feedback format | Details |

|---|---|

| Report to the Board of Directors | Report Q&A at financial results briefing and dialogue with individuals in charge of exercising voting rights on behalf of institutional investors |

| Quarterly IR activity report | Report summary of questions and opinions from institutional investors and analysts ascertained through IR activities |

| Other reports(Shareholder/Investor Relations) | Report shareholder composition, trends in stock holdings by institutional investors, and analyst report summary |

Results of dialogue

| Request | Result |

|---|---|

| Creating opportunities for dialogue with outside executive directors |

Conducting personal meetings between outside executive directors and the person in charge of exercising voting rights of institutional investors Held small meetings hosted by analysts with the participation of outside executive directors |

| Dividend stability and continuity |

Introduced a policy of progressively increasing dividends from fiscal 2024 |